43 defined benefit pension vs defined contribution

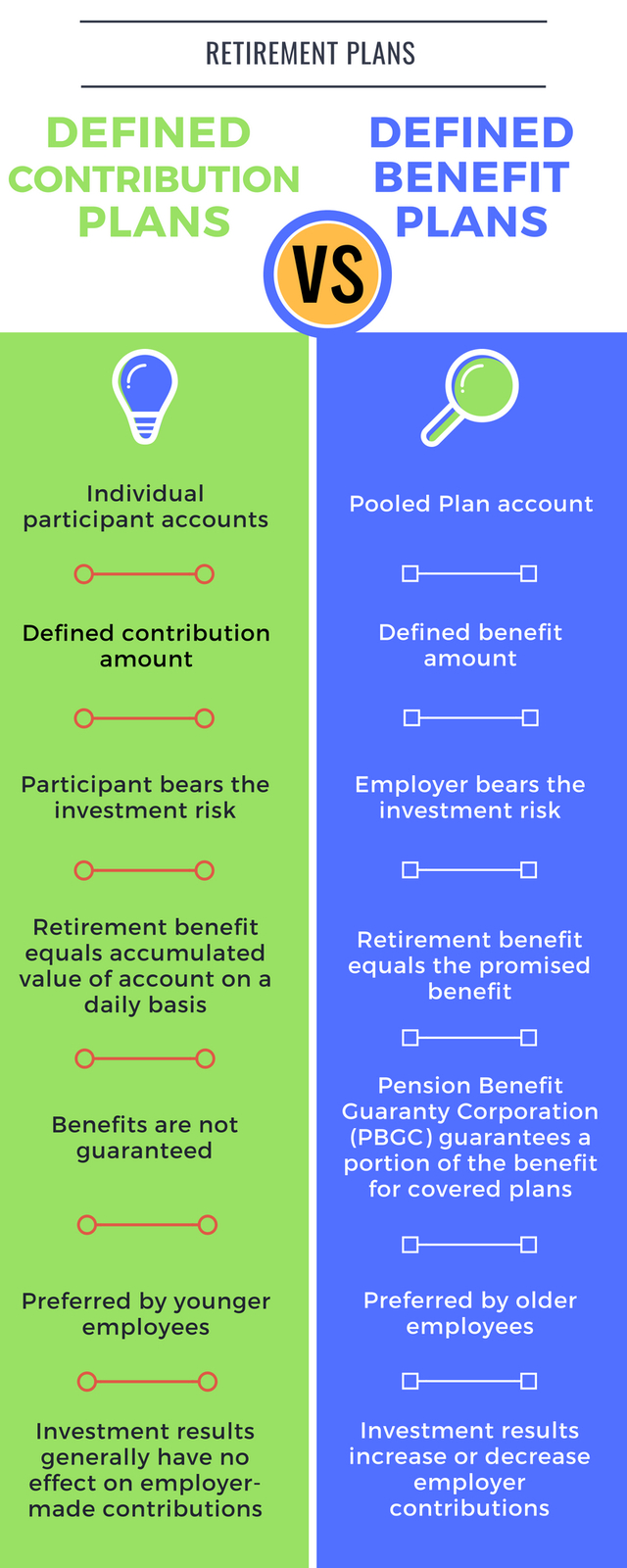

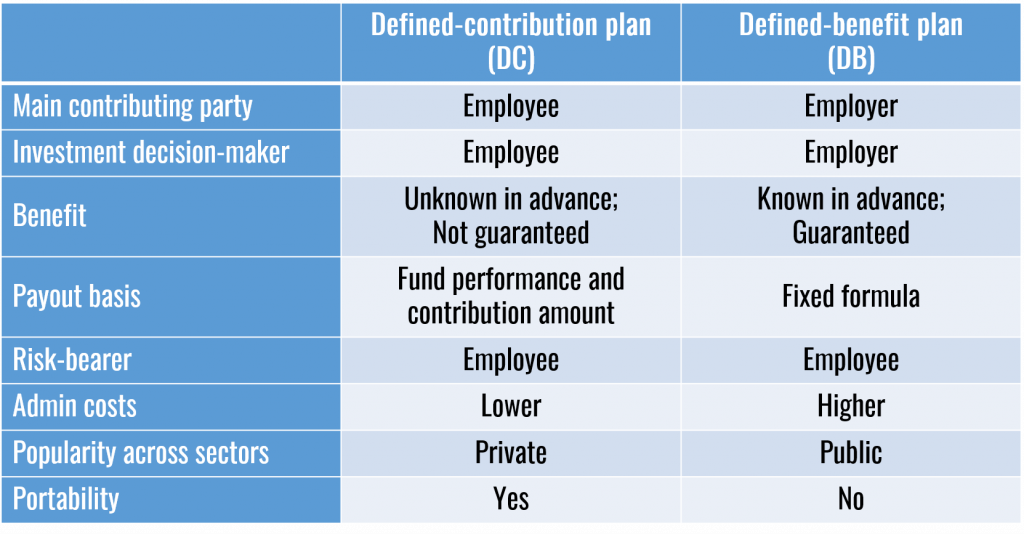

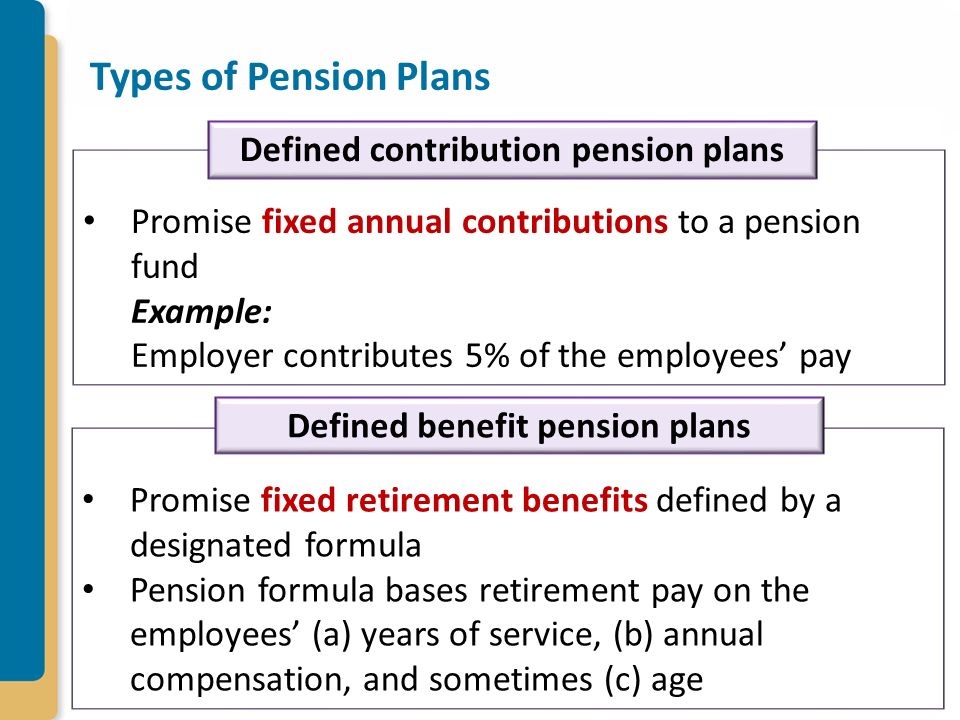

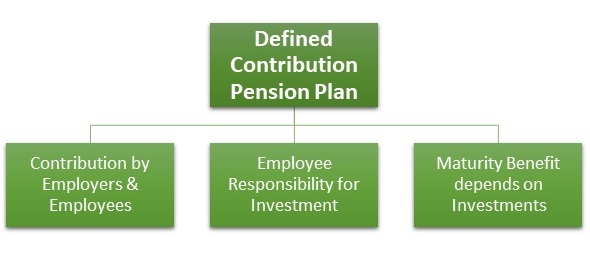

Defined Benefit vs. Defined Contribution: What Is the Best ... A defined contribution pension plan is one in which the employer and employee make contributions. Those contributions are invested over time to provide a payout at retirement. The final benefit amount of the pension is unknown because it is based on contributions and growth. Defined Benefit vs. Defined Contribution ... - MWRA Retirement The current contribution is guaranteed but not a level of benefits at retirement, as in a defined benefit plan. In 1993, 49 percent of full-time employees in medium and large private establishments participated in one or more defined contribution plans, up from 45 percent in 1988 (U.S. Department of Labor, 1994).

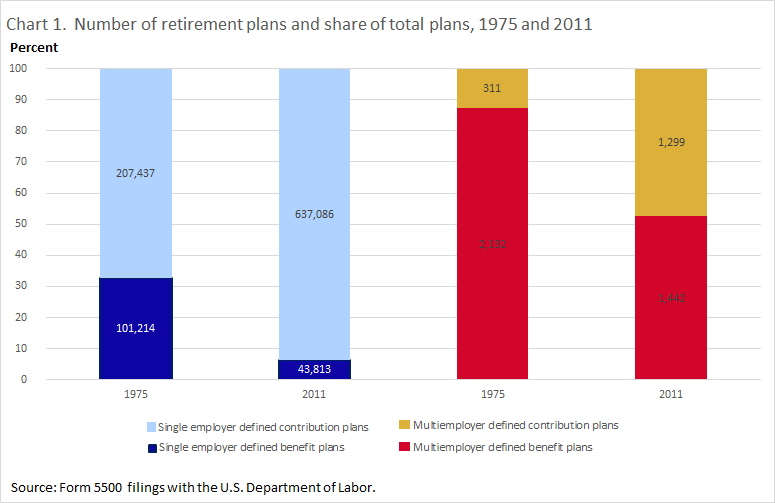

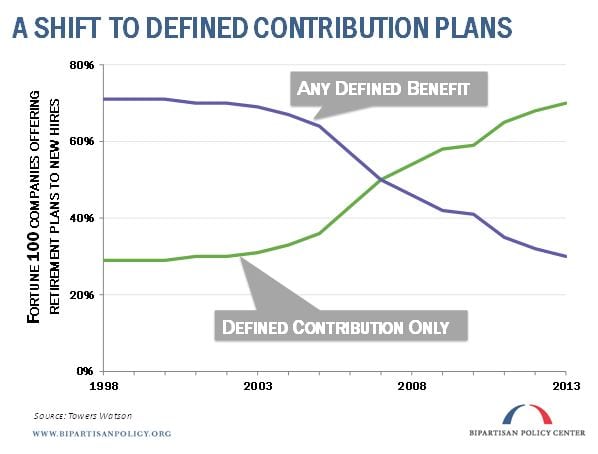

advisory.kpmg.us › articles › 2019Defined benefit plans: IFRS® Standards vs. US GAAP Defined benefit vs. defined contribution plans under IFRS Among employers, there has been a general movement away from defined benefit plans and toward defined contribution plans in recent years. 4 In 2019, only 16% of private sector workers in the United States have access to a defined benefit plan, while 64% have access to a defined ...

Defined benefit pension vs defined contribution

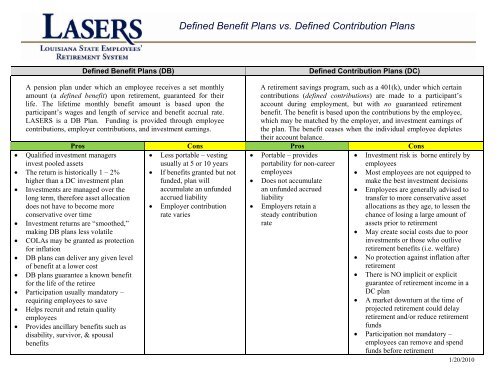

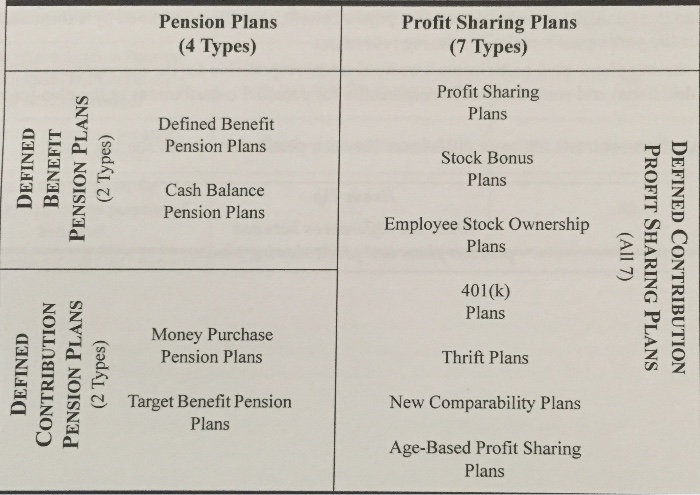

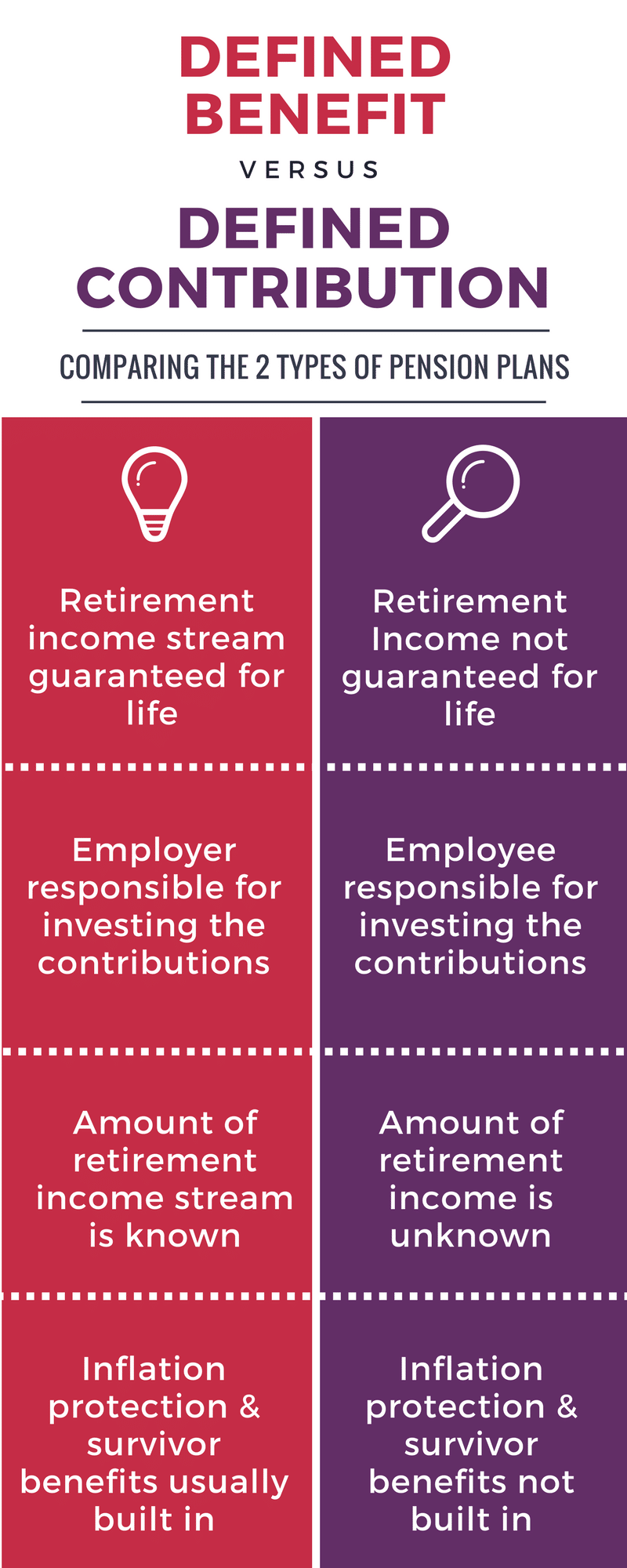

Defined-Contribution Plan Vs. Defined-Benefit Pension Plan ... In a defined-contribution plan, the employer has no obligation to provide the employee with an income upon retirement. Alternatively, a defined- benefit pension plan has your employer taking a lot more of the risk and promising a specified pension payment amount when you retire. This is referred to as your pension's " commuted value ". Defined Benefit Pension vs Defined Contribution Pension ... With retirement being a hot topic in personal finance, I get a lot of questions regarding the differences between a defined benefit pension plan and a defined contribution pension plan. Even though both have similar names, they have vast differences as to what it means for the retiree. Defined Benefit Pension (DBP) A defined benefit pension (gold-plated) is just as it sounds. Defined Benefit vs. Defined Contribution Retirement Plans ... Defined benefit plan payouts have become less popular as a private-sector tool for attracting and retaining employees. 1. Defined Contribution Plan Advantages. Deferred contribution plans rely on employee contributions and can include employer matching funds. The most common defined contribution plans are regular and Roth IRAs and 401(k) plans.

Defined benefit pension vs defined contribution. › ask › answersDefined-Benefit vs. Defined-Contribution Plan Differences Dec 12, 2021 · Employers fund and guarantee a specific retirement benefit amount for each participant of a defined-benefit pension plan. Defined-contribution plans are funded primarily by the employee, as the ... Defined Benefit Plan vs Defined Contribution Plan | What ... Welcome to the Morning Ride Wealth Guide. This is where we cover quick tips on your morning trip, for all things related to your wealth and retirement. These... Defined-Benefit vs. Defined-Contribution Plan · Know ... Defined benefit plans define your future benefit upfront or at least the parameters on which that benefit will be based. Retirement benefits from a defined contribution plan are a function of contributions to the account by the plan participant and any employer contributions, along with the investment returns earned by the plan participant. saberpension.com › 2019/07/25 › defined-benefit-planDefined Benefit Plan Rollover to an IRA. What ... - Saber Pension Jul 25, 2019 · Direct Rollover vs. 60-Day Rollover. There are two ways to rollover a Defined Benefit distribution: a direct rollover or a 60-day rollover. As the name implies, a direct rollover is when the Plan paying the distribution makes a direct transfer to the IRA or employer plan receiving the funds.

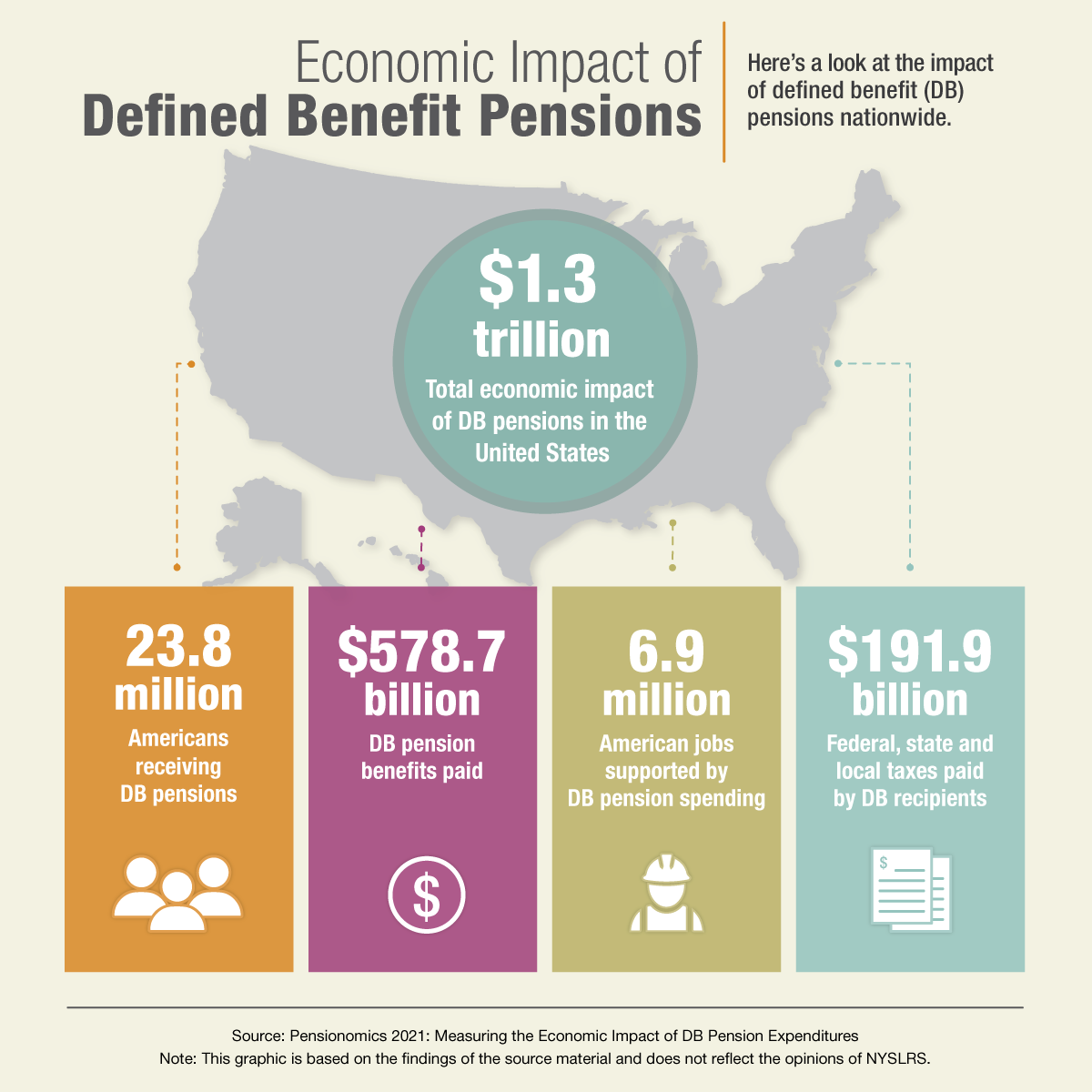

Defined Benefit Vs. Defined Contribution Pension Plans ... Instead of the contributions being based on your expected retirement payout, as in the defined benefit plan, the amount that an employer and/or employee can contribute is typically a percentage of... PDF Defined contribution retirement plans: Who has them and ... In 1988, when defined contribution retirement plans were a fairly new concept in the workplace, Bureau of Labor Statistics (BLS) Commissioner, Janet L. Norwood wrote, "It is unclear whether the more rapid growth in defined contribution plans compared to defined benefit plans is a movement towards variable rather than fixed payments. What are defined contribution and defined benefit pensions ... If you have a defined benefit pension, your scheme should tell you what your projected annual income is. This income will rise each year of your retirement in line with inflation. saberpension.com › 2020/07/01 › defined-benefitHow are Defined Benefit Plans Taxed? Impact ... - Saber Pension Jul 01, 2020 · However, unlike a Defined Contribution Plan, a Defined Benefit Plan provides covered employees with a retirement benefit based on a predefined formula. Defined Benefits typically are paid for by the employer, and Defined Benefit rules require employers to pre-fund pension benefits in a pooled trust account.

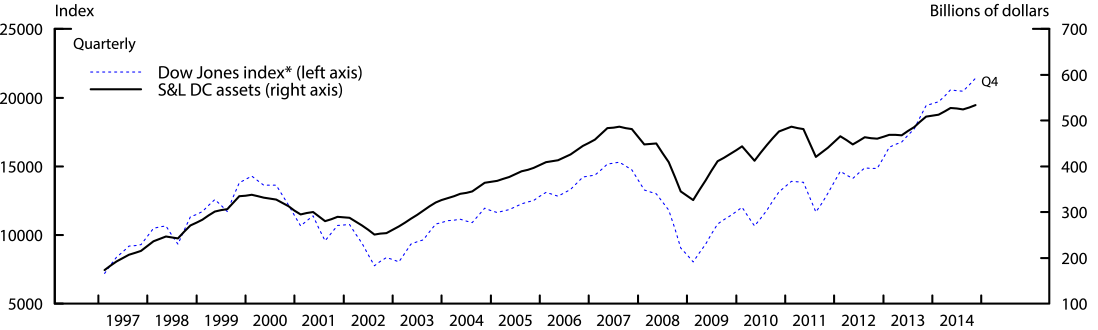

Defined Benefit Pensions vs Defined Contribution Pensions Defined Benefit plans are dying. There is clear shift world wide from Defined Benefit (DB) plans to Defined Contribution )DC) plans. In 2000, 65% of pensions were Defined Benefit plans but by 2010 only 56% of all pensions were Defined Benefit. In the US, DB plans were about 51% of all pensions in 2000. Ten years later, than number dropped to 43%. Defined Benefit Vs. Defined Contribution Retirement Plans Whereas the emphasis of defined benefit plans is on the payout, the emphasis on defined contribution plans is on the contribution (via employee or employer via a 401K match) - and this is the #1 distinguishing characteristic between the two. Secondly, individuals own the funds, once contributed. Defined Contribution vs Defined Benefit - Pension Plus Occupational pension Scheme (company pensions) in Ireland can generally be described as either defined benefit or defined contribution. (DB or DC) Defined Benefit (DB) schemes Defined benefit schemes aim to provide a set level of pension and/or lump sum at retirement. What is a Defined Benefit Pension Plan? - DBA The difference between defined benefit and defined contribution pension plans is that, instead of providing a defined income after retirement, a defined contribution plan empowers an employee to contribute a fixed percentage of their income to their benefit. The employer then deposits that contribution on their behalf.

Defined Benefit vs. Defined Contribution | Workforce.com * Fundamental features of defined benefit and defined contribution plans that cannot be modified without changing the plan into another type. 1—Normal retirement age 2—Fundamental features of DB and DC plans that cannot be modified without changing the plan into another type 3—Exception in state and local plans 4—Cost of living adjustments

› defined-benefit-pension-explainedDefined Benefit Pension Plan Canada: The Ultimate Guide ... Mar 01, 2021 · Defined benefit pension plan Canada: The ultimate guide from someone who actually has a defined benefit pension plan (yours truly). Oftentimes I think of my defined benefit pension plan (DBP) is like a Set for Life Scratch & Win– except that I would have to work for another 20 years to be ‘set for life’ and have a full pension which really, would not be ideal, nor would it be the Fat ...

› pensions-retirement › faqsDefined Benefit vs Defined Contribution (Difference) | Zurich ... The main difference between a defined benefit scheme and a defined contribution scheme is that the former promises a specific income and the latter depends on factors such as the amount you pay into the pension and the fund's investment performance. When choosing a pension, there are numerous pension plan options available.

Defined Benefit Vs. Defined Contribution Pension Plans ... A defined contribution plan is a plan that does not pay a specific benefit when you retire, but allows you to save money in a tax-deferred account. A 401k is a common type of defined-contribution plan. At retirement, you withdraw this money over time for living expenses. Your employer usually contributes to a defined-contribution plan also ...

Difference Between Defined Benefit and Defined ... the key difference between defined benefit pension and defined contribution pension is that a defined benefit pension is a pension plan in which an employer contributes with a guaranteed lump-sum on employee's retirement that is determined based on the employee's salary history and other factors whereas a defined contribution pension is a savings …

Defined Benefit vs. Defined Contribution: Choosing the ... As the names imply, a defined-benefit plan—also commonly known as a pension plan—promises a specified benefit amount at retirement. The benefit usually is defined via a plan formula based on the employee's pay and/or years of service and the (guaranteed) benefit is payable for the employee's lifetime.

Defined Benefit vs. Defined Contribution - Which Is Better ... Employer contributions are guaranteed and formula-derived, yet income levels at retirement for the employee are dependent upon the fund's performance. Under a defined benefit plan, the employer provides all contributions to the employee's account. The plan is formula-driven, and income levels for the employee at retirement are secure.

Defined benefit vs. defined contribution - Ontario Pension ... PSPP defined benefit. Defined contribution. You have guaranteed income for the rest of your life. Your pension is guaranteed by the Government of Ontario. You may outlive your pension. Your pension stops when your savings are depleted, unless you buy a life annuity. Your pension is managed by a team of investment experts.

Defined benefit vs. defined contribution: What is the best ... A defined contribution pension plan is one in which the employer and employee make contributions. Those contributions are invested over time to provide a payout at retirement. The final benefit amount of the pension is unknown because it is based on contributions and growth.

Defined Benefit vs Defined Contribution Pension Plans ... With a defined benefit pension, both the employer and employee usually contribute to the plan. These contributions are pooled into a fund, which your employer must properly invest to ensure it has...

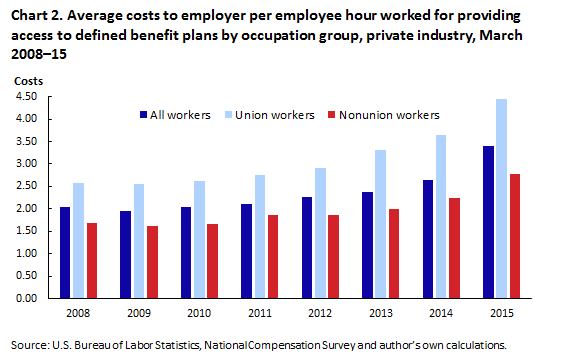

Defined Benefit vs. Defined Contribution: Understanding ... Among the most commonly cited reasons for the ongoing shift from defined benefit (DB) to defined contribution (DC) retirement plans has been the perception that the latter is a more cost-efficient way to provide retirement benefits to employees.. But comparing the expenses between a DB plan and a DC plan is a difficult task for a plan sponsor, given all the variables that impact a plan.

Defined Benefit vs Defined Contribution Pension - Money We ... As the name implies a defined benefit pension plan gives you a fixed income when you retire. The formula used to determine your yearly payout is usually years of service multiplied by a percentage of your yearly salary (usually around 2%).

Teacher Retirement: Defined Benefit vs Defined Contribution 1. Defined Benefit Plans Otherwise known as pension plans, defined benefit plans are employer-sponsored and are a fixed monthly amount to be received after your retirement. The employer shoulders the investment risks. To Consider:

› pensions-explained › pensionWhat is a defined benefit pension? | Final salary pension Dec 08, 2021 · Defined contribution vs. defined benefit pensions. While the amount of money your defined contribution pension is worth on retirement depends on how much you’ve paid in and how your investments have performed, the value of a defined benefit pension is based on:

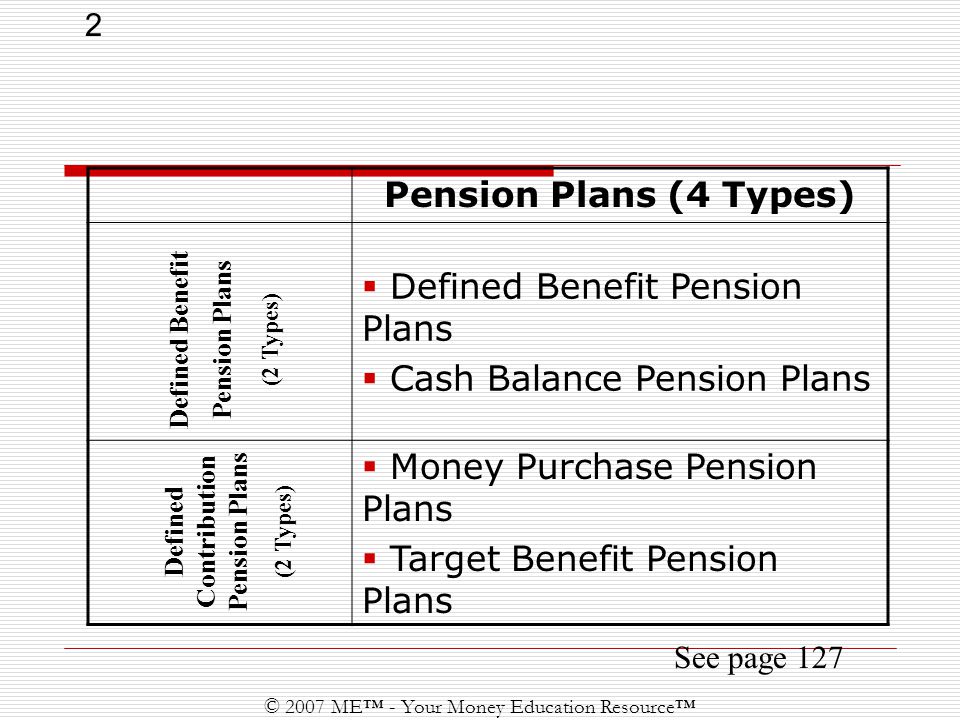

Types of private pensions - GOV.UK There are 2 main types: defined contribution - a pension pot based on how much is paid in defined benefit - usually a workplace pension based on your salary and how long you've worked for your...

Defined Benefit vs. Defined Contribution Retirement Plans ... Defined benefit plan payouts have become less popular as a private-sector tool for attracting and retaining employees. 1. Defined Contribution Plan Advantages. Deferred contribution plans rely on employee contributions and can include employer matching funds. The most common defined contribution plans are regular and Roth IRAs and 401(k) plans.

Defined Benefit Pension vs Defined Contribution Pension ... With retirement being a hot topic in personal finance, I get a lot of questions regarding the differences between a defined benefit pension plan and a defined contribution pension plan. Even though both have similar names, they have vast differences as to what it means for the retiree. Defined Benefit Pension (DBP) A defined benefit pension (gold-plated) is just as it sounds.

Defined-Contribution Plan Vs. Defined-Benefit Pension Plan ... In a defined-contribution plan, the employer has no obligation to provide the employee with an income upon retirement. Alternatively, a defined- benefit pension plan has your employer taking a lot more of the risk and promising a specified pension payment amount when you retire. This is referred to as your pension's " commuted value ".

/WorkRetirement-56eeac473df78ce5f8395f69.jpg)

0 Response to "43 defined benefit pension vs defined contribution"

Post a Comment