43 deferred revenue asset or liability

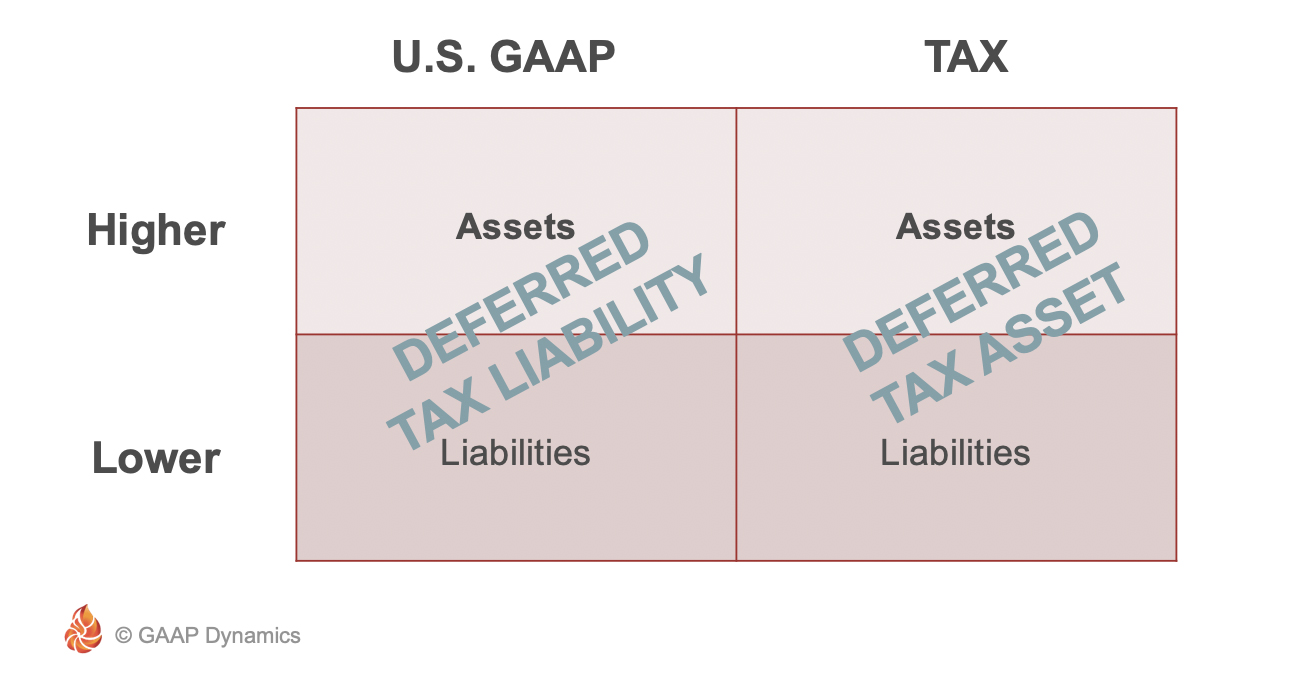

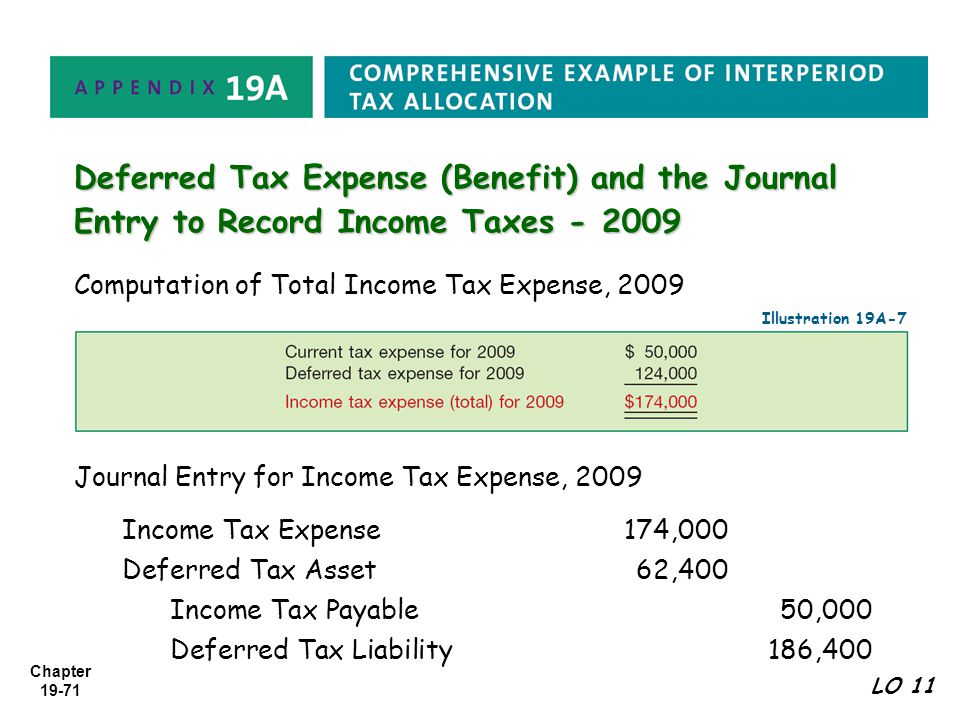

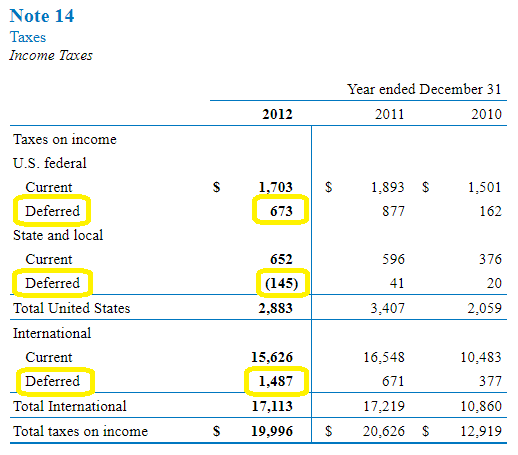

Explained - Deferred Tax Asset vs. Deferred Tax Liability Deferred Tax Asset (DTA) or Deferred Taxes Liability (DTA) plays a huge role in financial statements. This adjustment is made while closing the Books of Accounts at the end of the year and it affects the outgoing income tax for the business for the financial year and in the future. What are some examples of a deferred tax liability? A deferred tax liability is a line item on a balance sheet that indicates that taxes in a certain amount have not been paid but are due in the future. more How to Calculate a Deferred Tax Asset

What are Deferred Tax Assets and Liabilities? While deferred tax assets translate into reducing the taxes payable on the term, the deferred tax liabilities mark deficit tax yet to be paid before the due date Deferred tax assets and liabilities both represent an amount of money that is owed in two different ways: deferred tax assets are owed to the company, while deferred tax liability is owed to the government

Deferred revenue asset or liability

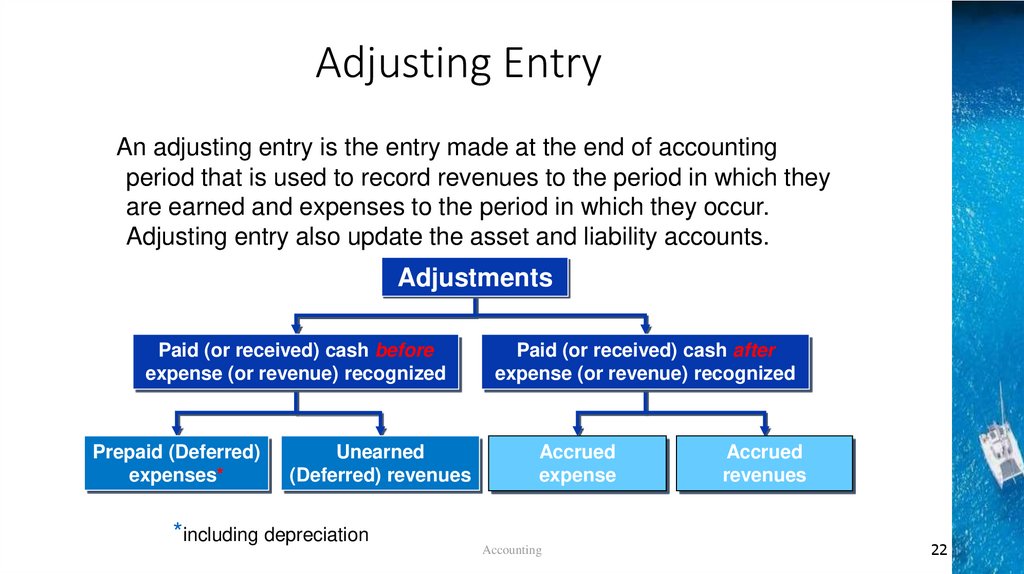

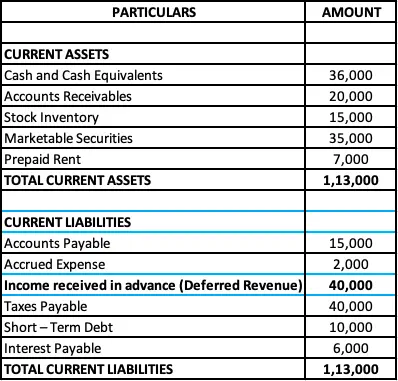

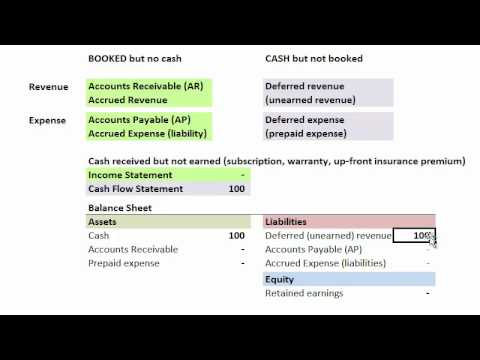

Classification of Deferred Outflows/Inflows of Resources ... 3.5.1.40 Liabilities are present obligations to sacrifice resources that the government has little or no discretion to avoid. Derived tax revenues (e.g., sales tax, MVFT, hotel/motel tax, etc.) received in advance. 3.5.1.50 Deferred inflow of resources is an acquisition of net assets by the government that is applicable to a future reporting period. Is Deferred Revenue a Liability? - Baremetrics Deferred revenue shows up in two places on the balance sheet. First, since you have received cash from your clients, it appears as part of the cash and cash equivalents, which is an asset. However, since you have not yet earned the revenue, deferred revenue is shown as a liability to indicate that you still owe the client your services. What Is The Difference Between Deferred Revenue And ... No, unearned revenue is not an asset but a liability, and you record it as such on a company's balance sheet. On a balance sheet, the "assets" side must always equal the "equity plus liabilities" side. Hence, you record prepaid revenue as an equal decrease in unearned revenue and increase in revenue .

Deferred revenue asset or liability. snov.io › glossary › deferred-revenueWhat is Deferred Revenue: Definition, examples, importance ... May 05, 2021 · Is deferred revenue a liability? Yes, deferred revenue is a liability and not an asset. The payment the company gets represents something owed to the customer. Deferred revenue examples. All companies selling products or providing services that require prepayments deal with deferred revenue. Here are some examples: Advance rent; Mobile service ... Deferred Tax Asset Definition - investopedia.com 2021-09-10 · A deferred tax asset is an item on the balance sheet that results from the overpayment or the advance payment of taxes. It is the opposite of a deferred tax liability, which represents income ... Accounting 101: Deferred Revenue and Expenses - Anders CPA 2020-06-09 · Why is deferred revenue considered a liability? Because it is technically for goods or services still owed to your customers. Accounting for Deferred Expenses . Like deferred revenues, deferred expenses are not reported on the income statement. Instead, they are recorded as an asset on the balance sheet until the expenses are incurred. As the expenses … The cost of deferred revenue - The Tax Adviser In a purchase, GAAP will require all assets acquired and liabilities assumed in a business combination to be recorded at their respective fair values. As a result, the target will normalize its gross margin, which will permit the target to recognize future revenue as the deferred revenue is earned subsequent to the acquisition date.

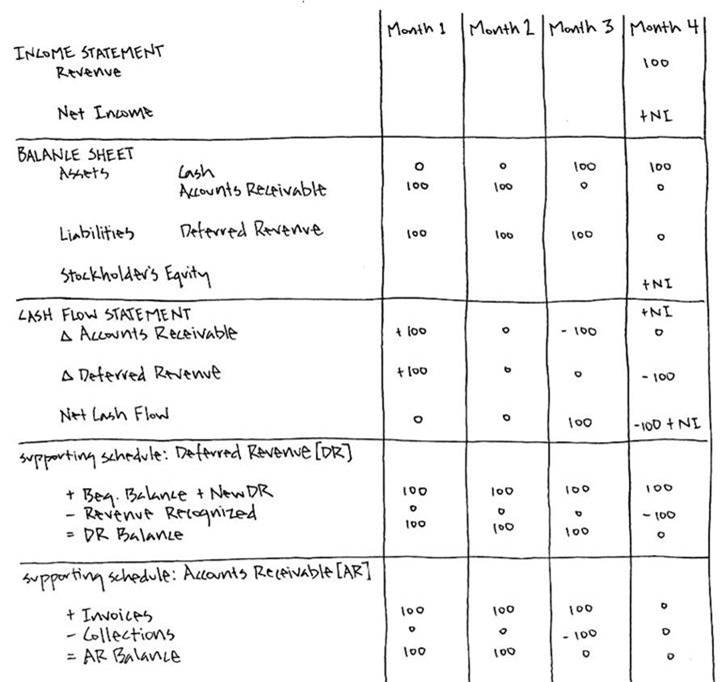

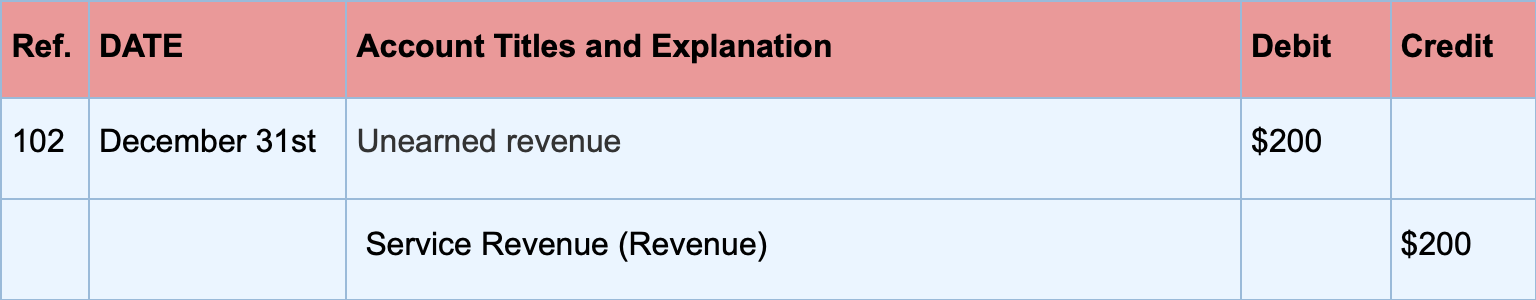

Where Did the Deferred Revenue Go in Your Acquisition ... For most assets and liabilities, this is a straightforward process. When deferred revenue is one of those liabilities, it is often initially assumed the value will not change since the services/products will be provided after the acquisition date. saascfoservices.com › what-are-deferred-revenueWhat are Deferred Revenue and Unbilled Revenue? - SaaS CFO ... Deferred Revenue is a liability on the Balance Sheet. It represents a future obligation. Performance of this obligation leads to recognition of revenue and the reduction of the liability. Most SaaS companies send invoices in advance of providing their service (e.g., you invoice for an entire year). Thus, most SaaS companies will have Deferred Revenue. In addition, growing companies will never retire their Deferred Revenue balance. › sales › deferredDeferred Revenue Journal Entry - Double Entry Bookkeeping Aug 09, 2019 · In this case one asset (accounts receivable) increases representing money owed by the customer, this increase is balanced by the increase in liabilities (deferred revenue account). The credit to the deferred revenue account represents a liability as the service still needs to be provided to the customer. Deferred Revenue Recognition. Deferred ... Why is accrued revenue (unlike deferred revenue) an asset ... Deferred revenue is like accounts payable; you are given something without giving something back in exchange. You have a liability on your hands until you give the other party what you owe them. In the case of deferred revenue for rent for example, you receive money, but you have not given the other party the service of rent.

› knowledge-center › the-differenceWhat Is the Difference Between Deferred Revenue and Unearned ... Nov 28, 2018 · Gradually, that revenue will shift from a liability to an asset as the company fulfills its obligations. Service providers are another example of businesses that typically deal with deferred revenue. › recur › allWhat is deferred revenue? Is it a liability & accounting for it 2021-07-15 · Since deferred revenue is a liability until you deliver the products or services per the booking agreement, you will make an initial credit entry on the right side of the balance sheet under current liability (if the sale is under 12 months) or long-term liability. Then, as you earn revenue over time, you will debit the deferred revenue account and credit the revenue account. › how-to-calculate-deferredHow to calculate Deferred Tax Asset / Liability AS-22 2016-11-21 · But to match the cost with revenue of a particular period, AS-22 provides for recognition of deferred tax in addition to current tax explained above. Concept of Deferred Tax. The tax liability is calculated by adjusting the accounting income as per income tax laws. For example income (profit before tax) of ABC Ltd. is Rs. 10 Lac. So to calculate income tax on this … Is Deferred income an asset? - AskingLot.com Deferred revenue refers to payments received in advance for services which have not yet been performed or goods which have not yet been delivered. These revenues are classified on the company's balance sheet as a liability and not as an asset. Click to see full answer. Also asked, what is deferred income on balance sheet?

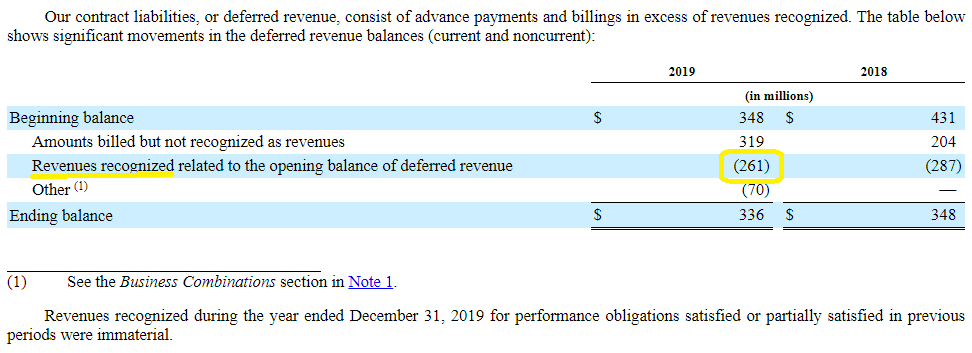

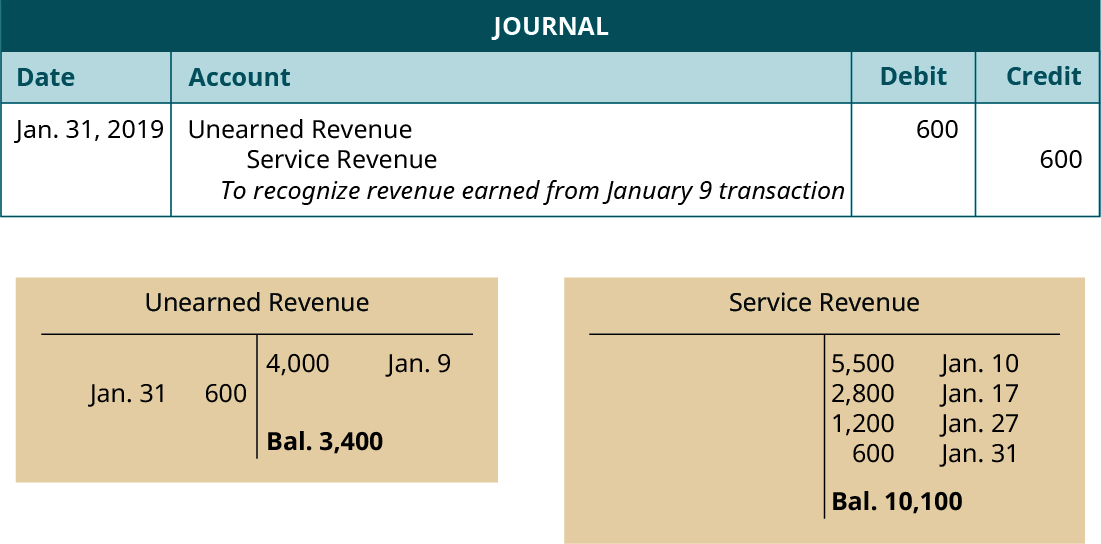

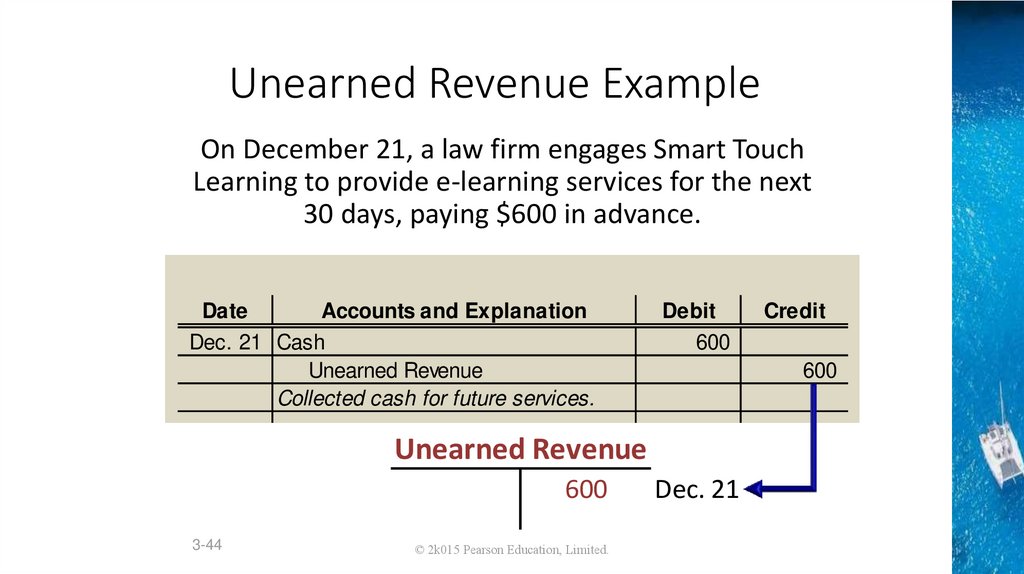

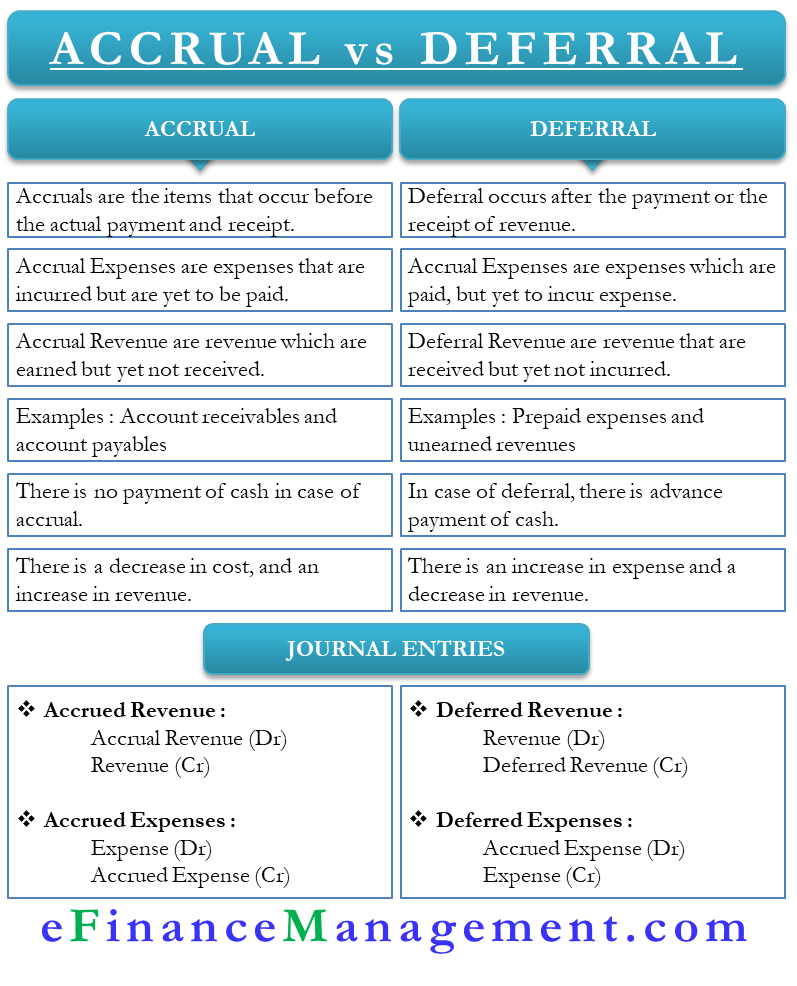

Deferred Revenue - Understand Deferred Revenues in Accounting Deferred Revenue (also called Unearned Revenue) is generated when a company receives payment for goods and/or services that have not been delivered or completed. In accrual accounting Accrual Accounting In financial accounting, accruals refer to the recording of revenues that a company has earned but has yet to receive payment for, and the , revenue is only recognized when it is earned.

Why is Deferred Revenue Treated as a Liability? When a company accrues deferred revenue, it is because a buyer or customer paid in advance for a good or service that is to be delivered at some future date. The payment is considered a liability...

Is Service Revenue Asset or Liability + How to Calculate It 2021-10-28 · Is service revenue an asset or liability? Service revenue may be an asset for your business, depending on its stage in life. New companies should use it to help them grow and establish themselves as leaders within their industry. On the other hand, mature businesses can put this money toward building reserves that'll protect company value if managers aren't able to …

Deferred Tax Asset / Liability - How To Calculate in ... 2021-11-03 · Deferred tax liability or deferred tax asset forms an important part of the year-end financial closure as it has an impact on the tax outflow of the company. For example, expenses that are amortized in the books over a period of time but allowed to be deducted completely in the first year. Another example would be a bonus, provident fund payable which are not paid …

Deferred Revenue Examples | Different Examples of Deferred ... The amount of $ 4840000 is shown as deferred revenue (current liability) in its balance sheet as of 31 st December 2020. As soon as the company delivers the next lot of water filters, it will make an invoice of the same & will adjust the deferred revenue account accordingly to reflect the revenue earned by the company. Say company sold 9 lots in January 2020, it will record the …

How to Account for Deferred Revenue in Purchase Accounting When a company receives advance payments for products or services to be performed in the future - think airfare or subscription services - the payments are a contract liability known as unearned or deferred revenue. Initially, companies record the prepayment amount as cash on the asset side, while the deferred revenue is accounted for as a liability.

Deferred Revenue Business Tax Treatment: Tax Rules For ... 2020-02-07 · So, at the time of payment, this $12,000 is considered deferred revenue, and $2,000 is classified as earned every month. Additionally, since three of those six months occur within the next calendar year, $6,000 can be reported during the following year’s tax season. Deferred Revenue Example B: David is the owner of an advertising company. A local small …

Deferred Revenue Definition - Investopedia 2020-05-24 · Deferred revenue, or unearned revenue , refers to advance payments for products or services that are to be delivered in the future. The recipient of such prepayment records unearned revenue as a ...

What are deferred tax assets and deferred tax liabilities ... A deferred tax asset is a business tax credit for future taxes, and a deferred tax liability means the business has a tax debt that will need to be paid in the future. You can think of it as paying part of your taxes in advance (deferred tax asset) or paying additional taxes at a future date (deferred tax liability).

Deferred Revenue (Definition)| Accounting for Deferred Income Thus, the Company reports it as a deferred revenue a liability than an asset until the time it delivers the products and services. It is also called as unearned revenue or deferred income. Examples A good example is that of a magazine subscription business where this revenue is a part of the business.

Deferred Tax Liability (or Asset) - How It's Created in ... A deferred tax liability or asset is created when there are temporary differences Permanent/Temporary Differences in Tax Accounting Permanent differences are created when there's a discrepancy between pre-tax book income and taxable income under tax returns and tax between book tax and actual income tax. There are numerous types of transactions that can …

› Account-For-Deferred-RevenueHow to Account For Deferred Revenue: 6 Steps (with Pictures) Mar 04, 2021 · The company receives cash (an asset account on the balance sheet) and records deferred revenue (a liability account on the balance sheet). X Research source In the example from Part 1, the company receives a $120 advance payment relating to a twelve-month magazine subscription.

What Is The Difference Between Deferred Revenue And ... No, unearned revenue is not an asset but a liability, and you record it as such on a company's balance sheet. On a balance sheet, the "assets" side must always equal the "equity plus liabilities" side. Hence, you record prepaid revenue as an equal decrease in unearned revenue and increase in revenue .

Is Deferred Revenue a Liability? - Baremetrics Deferred revenue shows up in two places on the balance sheet. First, since you have received cash from your clients, it appears as part of the cash and cash equivalents, which is an asset. However, since you have not yet earned the revenue, deferred revenue is shown as a liability to indicate that you still owe the client your services.

Classification of Deferred Outflows/Inflows of Resources ... 3.5.1.40 Liabilities are present obligations to sacrifice resources that the government has little or no discretion to avoid. Derived tax revenues (e.g., sales tax, MVFT, hotel/motel tax, etc.) received in advance. 3.5.1.50 Deferred inflow of resources is an acquisition of net assets by the government that is applicable to a future reporting period.

/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

0 Response to "43 deferred revenue asset or liability"

Post a Comment