43 pension plan definition

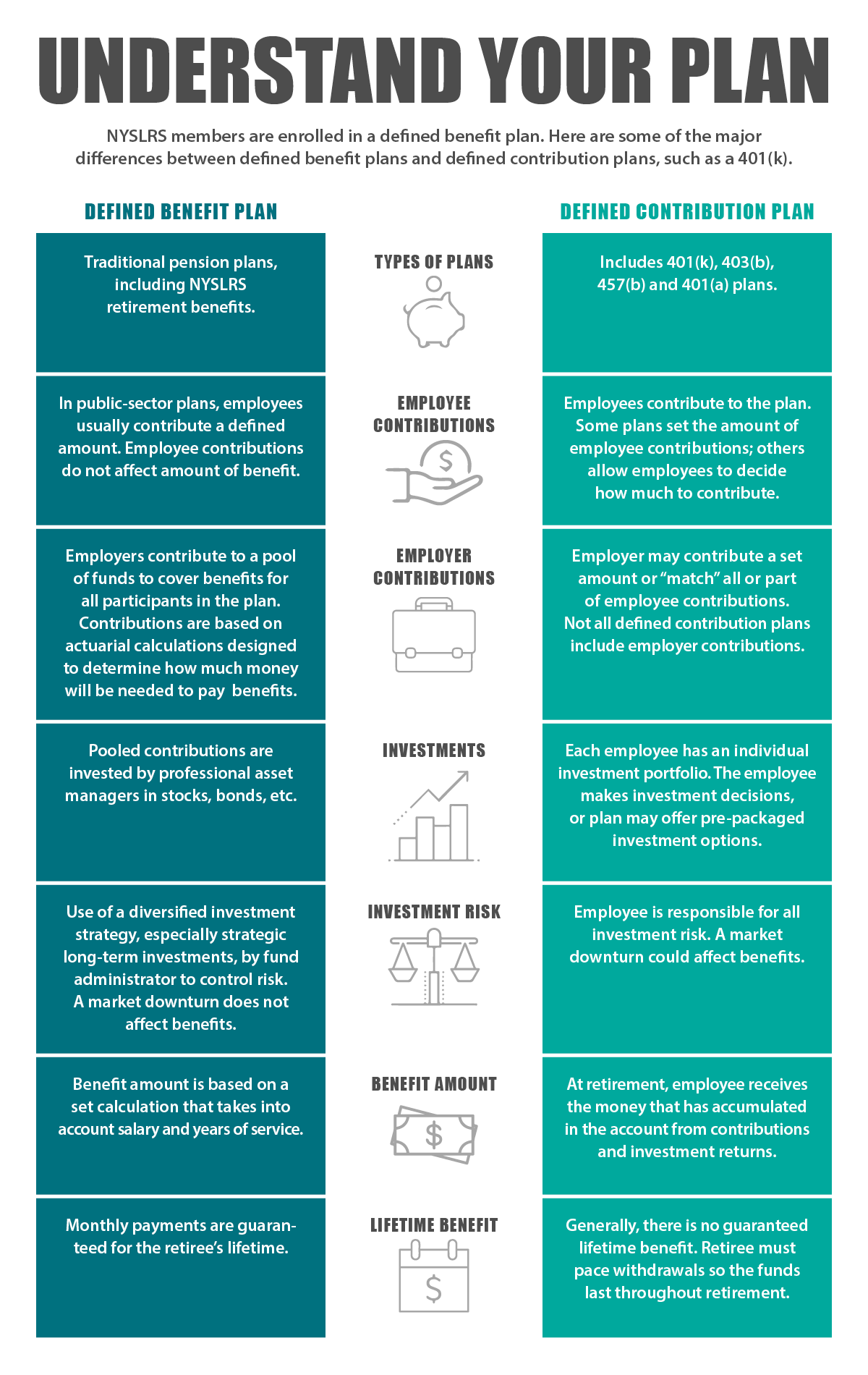

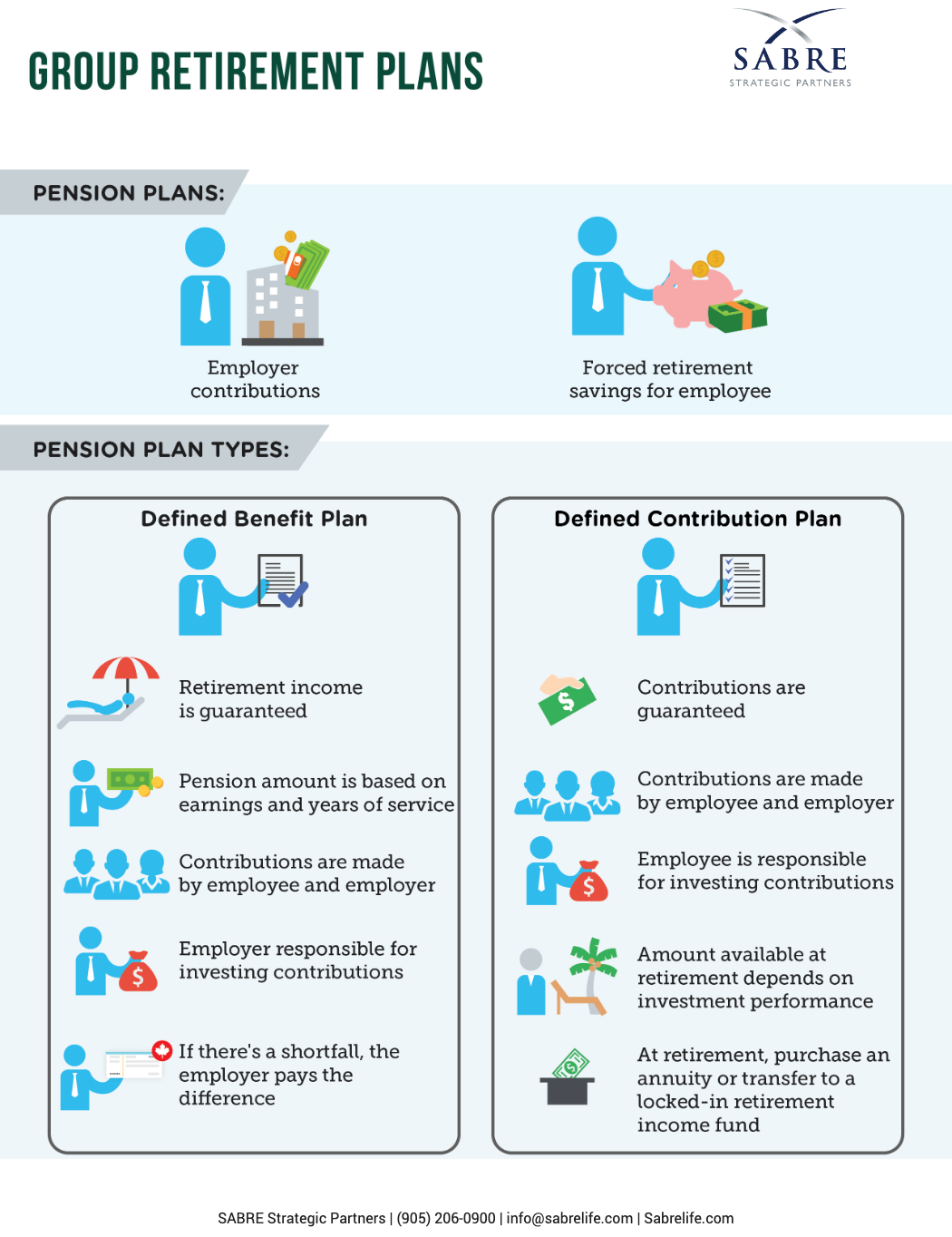

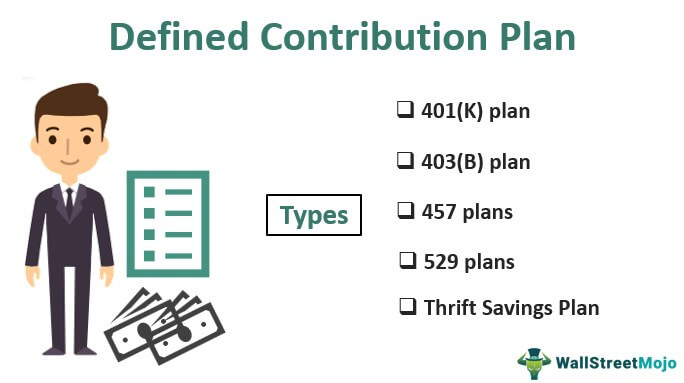

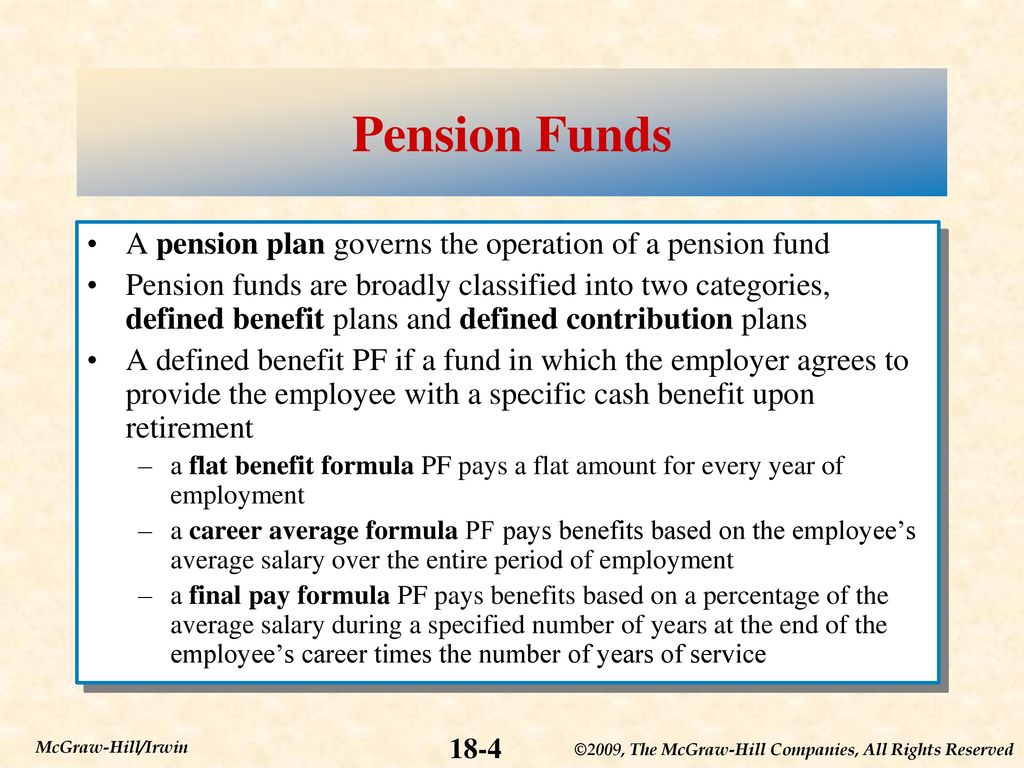

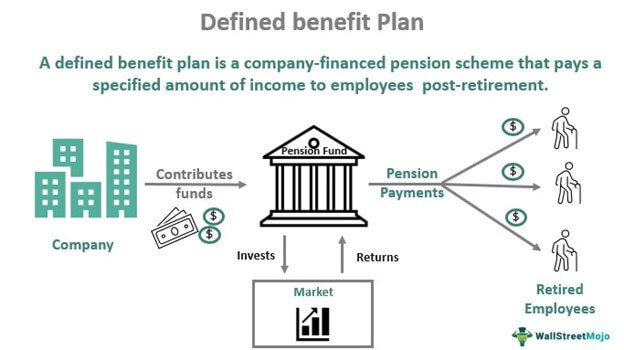

Defined-Benefit Plan Pensions are defined-benefit plans. In contrast to defined-contribution plans, the employer, not the employee, is responsible for all of the planning and investment risk of a defined-benefit plan.... Pension Plans: Definition, Types, Benefits & Risks ... 03.11.2021 · Pension Plans: Definition, Types, Benefits & Risks. Amelia Josephson Nov 03, 2021. A pension plan is a type of retirement plan where employers promise to pay a defined benefit to employees for life after they retire. It’s different from a defined contribution plan, like a 401(k), where employees put their own money in an employer-sponsored investment program. …

Defined-benefit pension legal definition of Defined ... Pension A benefit, usually money, paid regularly to retired employees or their survivors by private businesses and federal, state, and local governments. Employers are not required to establish pension benefits but do so to attract qualified employees. The first pension plan in the United States was created by the American Express Company in 1875.

Pension plan definition

Pension - Wikipedia A pension (/ ˈ p ɛ n ʃ ə n /, from Latin pensiō, "payment") is a fund into which a sum of money is added during an employee's employment years and from which payments are drawn to support the person's retirement from work in the form of periodic payments. A pension may be a "defined benefit plan", where a fixed sum is paid regularly to a person, or a "defined contribution plan", under ... What Is a Defined Benefit Plan? - SmartAsset A defined benefit plan is an employer-provided retirement program that pays employees fixed income payments when they retire. Here's how these plans work. Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email Loading Home Buying Calculators How Much House Can I Afford? Mortgage Calculator Rent vs Buy Closing Costs Calculator Types of Retirement Plans | Internal Revenue Service Individual Retirement Arrangements (IRAs) Roth IRAs. 401 (k) Plans. SIMPLE 401 (k) Plans. 403 (b) Plans. SIMPLE IRA Plans (Savings Incentive Match Plans for Employees) SEP Plans (Simplified Employee Pension) SARSEP Plans (Salary Reduction Simplified Employee Pension) Payroll Deduction IRAs.

Pension plan definition. Specified Canadian Pension Plan Definition | Law Insider Maintain, sponsor, administer, contribute to, participate in or assume or incur any liability in respect of any Specified Canadian Pension Plan, or acquire an interest in any Person if such Person sponsors, administers, contributes to, participates in or has any liability in respect of, any Specified Canadian Pension Plan. Pension expense definition - AccountingTools Nov 18, 2021 · Pension expense is the amount that a business charges to expense in relation to its liabilities for pensions payable to employees. The amount of this expense varies, depending upon whether the underlying pension is a defined benefit plan or a defined contribution plan. The characteristics of these plan types are noted below. Defined Benefit Plan Overfunded Pension Plan Definition 18.02.2021 · A pension plan that has a funding ratio of less than 100% means that it doesn't have enough funds to cover future liabilities or monthly benefits. A pension that's overfunded would have a funding ... Pension Plan: Definition, Types and How They Work | PointCard A pension plan is a specific benefit offered to employees by their employer. The employer allocates money consistently into a separate fund that workers are eligible to draw from once they retire. In the United States, most people opt for more specialized plans like 401 (k) plans or Roth 401 (k) plans instead of generalized pensions.

What does pension plan mean? - definitions Here are all the possible meanings and translations of the word pension plan. Princeton's WordNet (0.00 / 0 votes) Rate this definition: pension plan, pension account, retirement plan, retirement savings plan, retirement savings account, retirement account, retirement program noun a plan for setting aside money to be spent after retirement What Is a Pension and How Does It Work? - TheStreet A pension plan is a type of retirement plan where an employee adds money into a fund that includes contributions by the employer. The worker's pension payments are determined by the length of the ... What is a Pension Plan? Pension Plan Definition A pension plan is the retirement amount, which an individual gets from their insurance companies on a regular basis or in the form of a lump sum. There are various types of such plans available in Read more Best Pension Options Get Tax Free Pension For Life Flexibility to withdraw fund value any time Guaranteed Tax Savings Under Sec 80 C & 10 (10D) Defined benefit pension plan - Wikipedia A defined benefit (DB) pension plan is a type of pension plan in which an employer/sponsor promises a specified pension payment, lump-sum or combination thereof on retirement that is predetermined by a formula based on the employee's earnings history, tenure of service and age, rather than depending directly on individual investment returns. . Traditionally, many governmental and public ...

Definition and Example of a Pension - The Balance A pension is a retirement plan that provides a monthly income. The employer bears all of the risk and responsibility for funding the plan . Learn more about pensions, how they work, and what determines pension income for eligible retirees. Definition and Example of a Pension With a pension, your employer guarantees you an income in retirement. Pension Funds in India: Definition, Types, Plan Features ... 07.01.2022 · Hence, investing in a pension plan will support you when all other income streams cease to exist. In India, pension plans have two stages – the accumulation stage and the vesting stage. In the former, the investors pay annual premiums until they attain the age of retirement. Then, on reaching the retirement age, the second stage, also known as the vesting stage, … Pension Definition & Meaning - Merriam-Webster pension: [noun] a fixed sum paid regularly to a person:. wage. a gratuity granted (as by a government) as a favor or reward. one paid under given conditions to a person following retirement from service or to surviving dependents. Foreign Pension Plan Definition: 3k Samples | Law Insider Define Foreign Pension Plan. means any plan, fund (including, without limitation, any superannuation fund) or other similar program established or maintained outside the United States of America by the Borrower or any one or more of its Subsidiaries primarily for the benefit of employees of the Borrower or such Subsidiaries residing outside the United States of America, which plan, fund or ...

Pension Plan vs. 401(k): Types, Pros & Cons - NerdWallet Jan 12, 2022 · A pension plan is a retirement-savings plan typically funded by an employer. Money goes into the pension on behalf of the employee while the employee works for the organization. The employee ...

Defined-benefit pension plan financial definition of ... A pension plan in which retirement benefits rather than contributions into the plan are specified. Thus, a retired employee who has reached a certain age with a given number of years of service and has earned a certain income is entitled to a specific monthly pension payment.

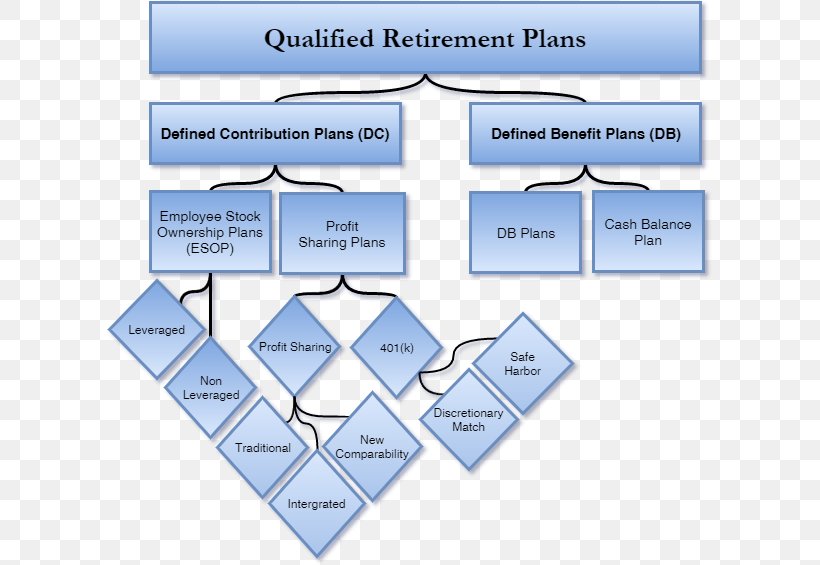

What is a Qualified Pension Plan? - Definition from ... A qualified pension plan is a pension plan that meets the requirements of the Internal Revenue Code Section 401 and the Employee Retirement Income Security Act of 1974 (ERISA), making the individuals eligible for specific tax benefits.

ERISA Pension Plan Definition | Law Insider canadian benefit plans means any material plan, fund, program, or policy, whether oral or written, formal or informal, funded or unfunded, insured or uninsured, maintained by a loan party or any subsidiary of any loan party, providing employee benefits, including medical, hospital care, dental, sickness, accident, disability, life insurance, …

Pension Plan Definition A pension plan is an employee benefit that commits the employer to make regular contributions to a pool of money that is set aside in order to fund payments ...30 Aug 2021Defined Benefit vs. Defined Contribution: What Is the Difference?How Long Does it Take to Get Vested Under a Pension Plan?

Defined Benefit Plan | Internal Revenue Service Defined benefit plans provide a fixed, pre-established benefit for employees at retirement. Employees often value the fixed benefit provided by this type of plan. On the employer side, businesses can generally contribute (and therefore deduct) more each year than in defined contribution plans.

Pension Plan Definition - ThePressFree A pension plan is a retirement plan that requires an employer to make contributions to a pool of funds set aside for a worker's future benefit. There are two main types of pension plans: the defined benefit and the defined contribution plan. A defined benefit plan guarantees a set monthly payment for life (or a lump sum payment on retiring).

Definition of Employee Pension Benefit Plan Under ERISA This section clarifies the limits of the defined terms "employee pension benefit plan" and "pension plan" for purposes of Title I of the Act and this chapter by identifying certain specific plans, funds and programs which do not constitute employee pension benefit plans for those purposes.

Pension plan Definition & Meaning - Merriam-Webster Definition of pension plan : an arrangement made with an employer to pay money to an employee after retirement Learn More About pension plan Share pension plan Dictionary Entries Near pension plan pension off pension plan pension scheme See More Nearby Entries Statistics for pension plan Cite this Entry "Pension plan."

Pension Plan Definition: 22k Samples | Law Insider Define Pension Plan. means any "employee pension benefit plan" (as such term is defined in Section 3(2) of ERISA), other than a Multiemployer Plan, that is subject to Title IV of ERISA and is sponsored or maintained by the Borrower or any ERISA Affiliate or to which the Borrower or any ERISA Affiliate contributes or has an obligation to contribute, or in the case of a multiple employer or ...

Pension Fund - Definition, Types, Benefits, How it Works? Pension Fund refers to any fund, plan, or scheme that is set up by an employer (or union) which generates regular income for employees after their retirement.

What Is a Pension Plan? - The Balance A pension plan is a type of employer-sponsored retirement plan that pays employees a set income during retirement, usually based on how long they worked for the company. These plans are becoming less common as more employers offer 401 (k) retirement plans.

PDF FAQs about Retirement Plans and ERISA - DOL Simplified Employee Pension Plan (SEP) - A plan in which the employer makes contributions on a tax-favored basis to individual retirement accounts (IRAs) owned by the employees. If certain conditions are met, the employer is not subject to the reporting and disclosure requirements of most retirement plans.

PENSION | meaning in the Cambridge English Dictionary pension definition: 1. an amount of money paid regularly by the government or a private company to a person who does…. Learn more.

Types of Retirement Plans | Internal Revenue Service Individual Retirement Arrangements (IRAs) Roth IRAs. 401 (k) Plans. SIMPLE 401 (k) Plans. 403 (b) Plans. SIMPLE IRA Plans (Savings Incentive Match Plans for Employees) SEP Plans (Simplified Employee Pension) SARSEP Plans (Salary Reduction Simplified Employee Pension) Payroll Deduction IRAs.

What Is a Defined Benefit Plan? - SmartAsset A defined benefit plan is an employer-provided retirement program that pays employees fixed income payments when they retire. Here's how these plans work. Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email Loading Home Buying Calculators How Much House Can I Afford? Mortgage Calculator Rent vs Buy Closing Costs Calculator

Pension - Wikipedia A pension (/ ˈ p ɛ n ʃ ə n /, from Latin pensiō, "payment") is a fund into which a sum of money is added during an employee's employment years and from which payments are drawn to support the person's retirement from work in the form of periodic payments. A pension may be a "defined benefit plan", where a fixed sum is paid regularly to a person, or a "defined contribution plan", under ...

/Balance_What_Is_A_Pension_And_How_Do_You_Get_One_2388766_V2-c977283a02f54f34ac6f31d018585830-ed6f412b721d4dfc85f6cac9184c78ab.jpg)

![PDF] CORPORATE GOVERNANCE AND MANAGERIAL OPPORTUNISM: THE ...](https://d3i71xaburhd42.cloudfront.net/0a71bf51f9f908546c1b93827abd306bbd4f4cf7/6-Table1-1.png)

0 Response to "43 pension plan definition"

Post a Comment