39 what is a non qualified retirement plan

Retirement Planning Flashcards | Quizlet Qualified plans, nonqualified plans, defined benefit, defined contribution, Individual retirement plans. What are the characteristics of a qualified plan? -Contribute with pre-tax dollars, which allows earnings to accumulate tax-free. -non-discriminatory. Retirement Planning: A 5-Step Guide for 2022 - NerdWallet The 5 steps of retirement planning are knowing when to start, calculating how much money you'll Examples are hypothetical, and we encourage you to seek personalized advice from qualified Here is a list of our partners. 5 Steps to Retirement Planning in 2022: An Introduction & How-to Guide.

Library | Retirement Planning | Learn more What are small business retirement plans? Social Security benefits are a key source of income for many Americans living in retirement. They provide a reliable amount of money every month that can increase with cost of living adjustments, and the benefits aren't directly affected by the ups and downs...

What is a non qualified retirement plan

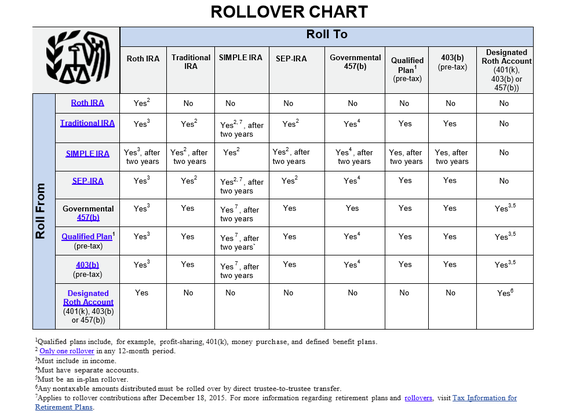

Solved: What is considered a "Qualified Retirement Plan"? Non-qualified plans are those that are not eligible for tax-deferral benefits. Internal Revenue Code Section 457 retirement plans for state and municipal employees and 403b programs for nonprofit organizations are nonqualified plans. A Guide to Common Qualified Plan Requirements | Internal ... A plan that provides for elective deferrals, for example a 401(k) plan, must provide that for each participant the amount of elective deferrals under the plan and all other plans, contracts, or arrangements of an employer maintaining the plan may not exceed the amount of the limitation in effect under Code section 402(g)(1) (Code section 401(a)(30)). In addition to the plan terms … Qualified vs. Non-Qualified – I Don’t Get It?! - CWM 14.01.2015 · If you’ve ever engaged in a conversation about retirement and you heard the terminology of qualified vs. non-qualified but you had no clue what that meant – know you’re not alone! The following is a basic explanation of the difference: Qualified investments are accounts that are most commonly known as retirement accounts and they receive certain tax …

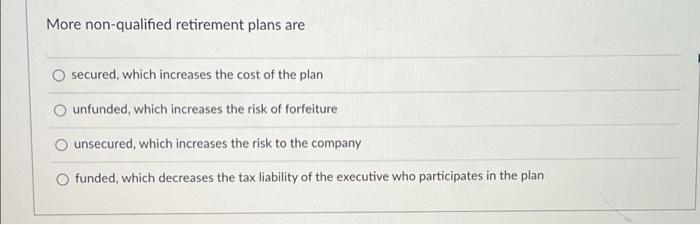

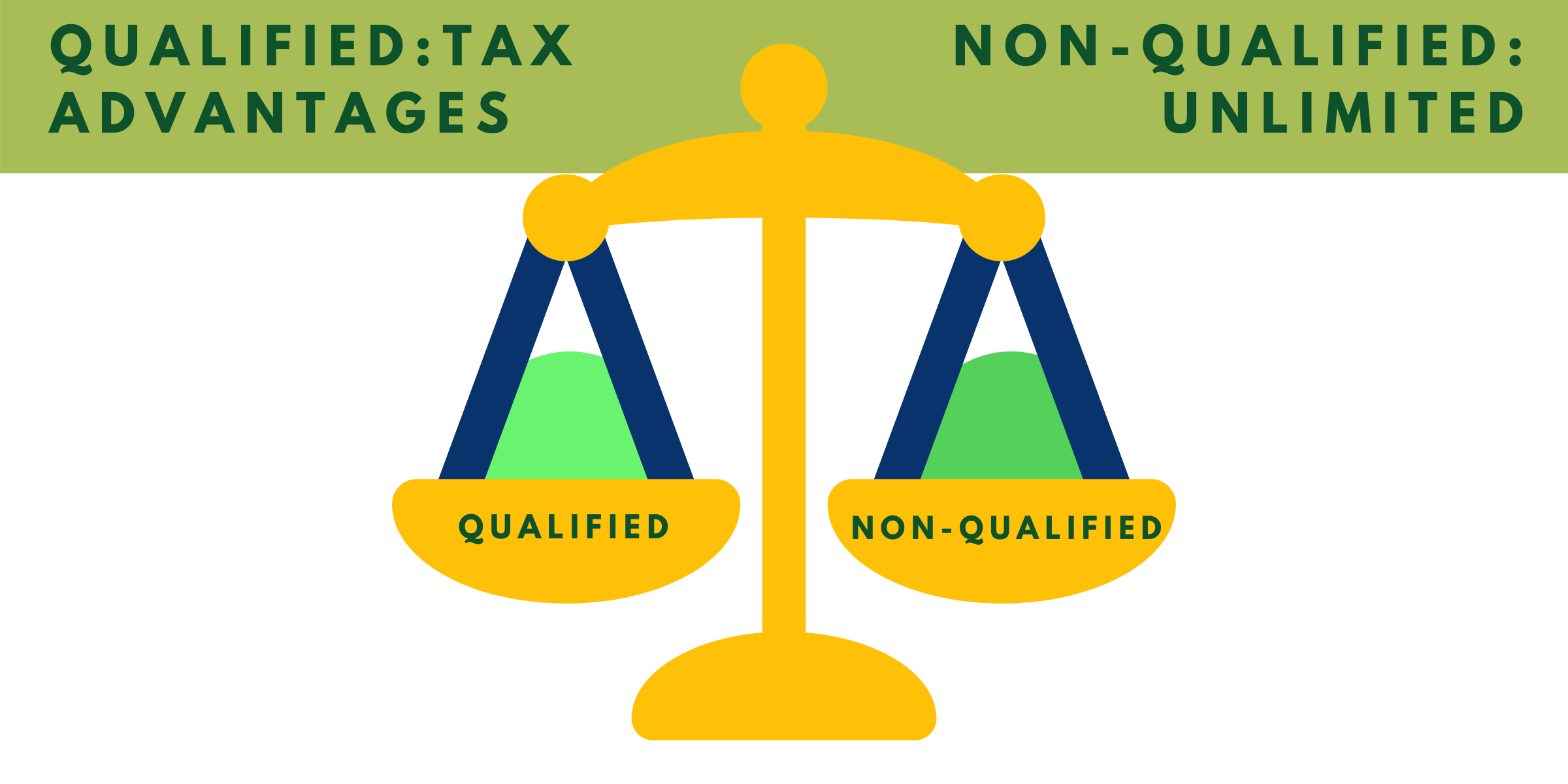

What is a non qualified retirement plan. Non-Qualified Retirement Plan Implications? : personalfinance If an employer offers a non-qualified retirement plan, like an IRA, what are the benefits and downsides for the employee compared to say, a traditional 401k? What is Non-Discrimination Testing? - Pentegra Retirement Services Our Non-Qualified Retirement Plan Solutions. Our Benefits Financing Advantage. The Top Heavy test is a calculation whereby the present value as of the determination date (the determination date is the last day of the prior plan year) of the accrued benefit of all key employees is determined and if the... Qualified vs. Non-Qualified Benefit Plans Non-qualified plans are employee benefit plans that do not meet ERISA guidelines, leaving a more flexible plan with a variety of possibilities for employees. An employer may decide to use these plans if they want to defer a greater amount of money to a retirement plan than that of a qualified plan... What Is The Difference Between Qualified And Non-Qualified... Qualified or Non-Qualified Pension Plans- What is Right for Your Business? In short, qualified pension plans are the most common type of retirement plan and are given more preferential treatment in the tax code. Non-qualified plans, on the other hand, have much less stringent requirements and...

9 Best Retirement Plans In February 2022 | Bankrate Nonqualified deferred compensation plans (NQDC). Key plan benefits to consider. Virtually all retirement plans offer a tax advantage, whether it's An IRA is a valuable retirement plan created by the U.S. government to help workers save for retirement. Individuals can contribute up to $6,000 to... Plan Services | Fiduciary Outsourcings Services ... Retirement Plan & Fiduciary Solutions. Fiduciary Solutions; Flexible Plans & Partnerships; TPA & 3(16) Solutions; MEPs PEPs & GoPs Solutions; Consulting Solutions; Retirement Plan Solutions Team; What Our Clients Have to Say About Us; Non-Qualified Plan & Benefits Financing Solutions. Our Non-Qualified Retirement Plan Solutions; Our Benefits ... Retirement Planning: The Ultimate Guide for 2022 Thankfully, planning for retirement is not overly onerous, but you will need a road map — one that can The reason is simple: you don't want to be going into your non-earning years owing money. The IRA is a tax-advantaged investing tool for individuals to earmark their retirement savings. Qualified Retirement Plan: What Is It & How It Works // Full Guide Qualified Retirement Plan Tax Treatment. Benefits Of Qualified Retirement Plans. The Bottom Line. Frequently Asked Questions. So, what is the difference between a qualified plan and a non-qualified plan? At a very basic level, qualified plans are protected through ERISA.

Retirement planning: What to do | Vanguard Retirement planning can be challenging. Here's a checklist of things to do before you retire. You're in the homestretch! The 5 to 10 years before you retire is a critical time for planning to meet your goal. › qualified-vs-non-qualifiedQualified vs. Non-Qualified Plans: What's the Difference? Nov 17, 2021 · Qualified retirement plans give employers a tax break for any contributions they make. Employees also get to put pre-tax money into a qualified retirement plan. All workers must get the same opportunity to benefit. A non-qualified plan has its own rules for contributions, but it offers the employer no tax break. Types of Retirement Plans | U.S. Department of Labor A defined benefit plan promises a specified monthly benefit at retirement. The plan may state this promised benefit as an exact dollar amount, such as A Simplified Employee Pension Plan (SEP) is a relatively uncomplicated retirement savings vehicle. A SEP allows employees to make contributions... Retirement plans in the United States - Wikipedia A retirement plan is a financial arrangement designed to replace employment income upon retirement. These plans may be set up by employers, insurance companies, trade unions, the government, or other institutions.

Planning for Retirement: Plan for the Retirement You Want - AARP Planning for retirement and retirement benefits made easier with the AARP retirement calculator and tips on when to collect 401k and other investments. Planning for Retirement. Social Security Resource Center.

non-qualified retirement plan - это... Что такое non-qualified... Non-Qualified Plan — Any type of tax deferred, employer sponsored retirement plan that falls outside of employee retirement income security act (ERISA) guidelines. Retirement plans in the United States — A retirement plan is an arrangement to provide people with an income, possibly a pension...

› ira-qualified-planIs an IRA a Qualified Plan? - Investopedia Dec 13, 2021 · A qualified retirement plan is an investment plan offered by an employer that qualifies for tax breaks under the Internal Revenue Service (IRS) and ERISA guidelines.

How Do I Report Non-Qualified Plan or Severance Payments ... 09.07.2018 · Employers commonly make payments to former employees for a number of reasons. Two of the more routine payments are those from a non-qualified deferred compensation plan (such as payments from a supplemental executive retirement plan or a 401(k) restoration-type plan) or pursuant to a severance arrangement, and sometimes both.

How Retirement Plan Assets Are Divided in a Divorce 26.10.2021 · A QDRO protects you, and it also ensures that a marital settlement does not allow the funds in the retirement plan to be withdrawn without penalty, and then deposited into the non-employee spouse’s retirement account (typically an IRA).Don't assume that your rights to retirement assets are covered just because your divorce decree states that you have a right to …

non-qualified retirement plan - definition of non-qualified retirement... Definition of Non-qualified Retirement Plan. A retirement plan that does not meet the IRS requirements for favorable tax treatment. Do you have a question that has not yet been answered? Let us know. Tel: +44 (0) 203 8794 460 or Email: support@advfn.com.

Life Insurance in a Qualified Retirement Plan 19.12.2021 · Qualified retirement plans that allow life insurance are defined contribution plans and defined benefit plans. If the plan is terminated early or …

Retirement Planning | Guides, Tools & Strategies Retirement planning involves setting goals for your retirement income, then creating a strategy and taking concrete steps to achieve them. It requires you to identify your sources of income, set up a savings plan, estimate your expenses during retirement and to plan for unforeseen events.

What to Know about ERISA Qualified Retirement Plans - Solo 401k A corporate 401k is an ERISA qualified retirement plan because it is employer defined and therefore employer sponsored. One of the biggest drawbacks of Non-ERISA accounts is the limited liability protection provided. Non-ERISA protection falls under Bankruptcy Abuse Prevention and Consumer...

merrillconnect.iscorp.com › nlg › viewDocumentAnnuity & Qualified Retirement Plan Insurance Withdrawal ... Section 4 - For Qualified Accounts Only (Not applicable to IRAs or Non Qualified accounts) 4a. Qualifying Events - May require proof of eligibility: Attainment of age 59½ (70½ for 457(b) gov't plans) Separated from employment. Employer Terminated Retirement Plan Active-Duty Reservist. Disabled Unforeseeable Emergency/Financial Hardship.

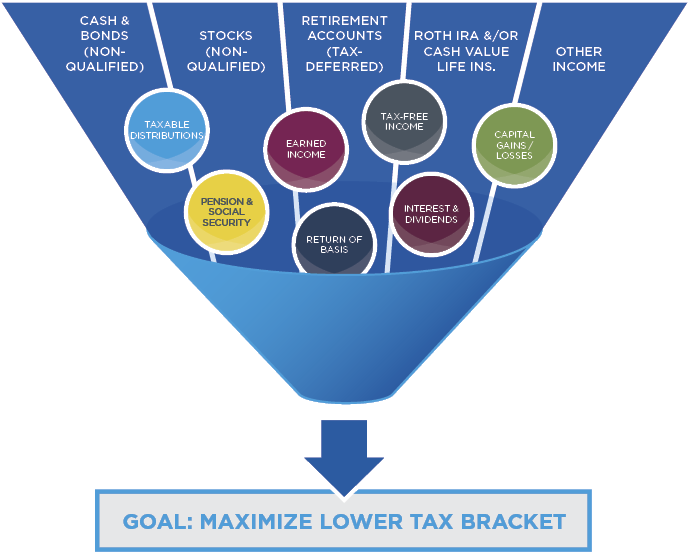

Tax Status: Qualified vs. Non-Qualified Funds - ELCO Mutual A non-qualified retirement plan, on the other hand, is funded with money that has already been taxed. Like qualified plans, funds in non-qualified plans grow on a tax-deferred basis. When funds are withdrawn, however, only growth is taxable. Which type of plan is better? Whether a qualified or non-qualified retirement plan will be more beneficial for you depends on when …

Retirement Topics - Qualified Joint and Survivor Annuity ... 28.09.2021 · A qualified plan like a defined benefit plan, money purchase plan or target benefit plan PDF must provide a QJSA to all married participants as the only form of benefit unless the participant and spouse, if applicable, consent in writing to another form of benefit payment. This consent can be submitted to the plan within 90-days of when annuity payments will begin. …

Solved: Is military retirement pay from a qualified or ... 01.06.2019 · Military retirement is considered a non-qualified plan. The term "qualified retirement plan" applies to plans covered by the Employee Retirement Income Security Act, or ERISA. ERISA only covers private sector retirement plans. The law does not cover public sector pensions including federal government plans such as the military retirement system. Military …

PDF Government & Non-Profit Retirement Plans A nonqualified retirement plan is one that does not meet the requirements of the IRC or ERISA. These plans may be discriminatory in their application and are A defined contribution plan is a qualified retirement plan in which the contribution is defined, but the ultimate benefit to be paid is not.

Qualified vs. Non-Qualified Annuities - SmartAsset 14.01.2020 · A qualified annuity differs from a non-qualified annuity in that it is funded by pre-tax dollars. Typically, you can invest in a qualified annuity through your employer’s retirement plan or a traditional IRA. Qualified annuity contributions depend on your income and eligibility for other qualified retirement plans.

Are Roth IRAs qualified or non qualified plans? - Quora A qualified retirement plan is a workplace retirement plan that falls under the jurisdiction of a law called ERISA (Employee Retirement Income Security Act). A QDRO (qualified domestic relations order) is a court-ordered withdrawal from a workplace retirement plan to pay a divorce settlement...

The Best Retirement Plans Of 2022 - Forbes Advisor And, unlike other retirement plans, annuities aren't subject to IRS contribution limits, so you can Qualifying employees designated by employer. Federal requirements determine who employer must offer If you are a small business owner and don't have another retirement plan for your employees...

403(b) Plan: Definition, Example, Explanation A 403(b) plan is a retirement plan for employees of public schools, nonprofits, and religious organizations. A 403(b) plan is a tax-deferred retirement account that's generally for employees of public Have a qualified reservist, birth, or adoption distribution. Have certain distributions of lifetime...

Qualified vs. Nonqualified Retirement Plans: What's the Difference? Qualified and nonqualified retirement plans are created by employers with the intent of benefiting employees, but what is the difference? A qualified retirement plan meets the guidelines set out by ERISA. Qualified plans qualify for certain tax benefits and government protection.

How to Use a Supplemental Executive Retirement Plan | US News A SERP is a non-qualified retirement plan that doesn't have to be offered to all employees. Many companies provide SERPs to employees with significant salaries. "Typically, they are negotiated as part of a larger compensation package with the employee," says James Philpot, an associate professor of...

Qualified Retirement Plan - Investopedia Sep 24, 2020 · A qualified retirement plan meets the requirements of Internal Revenue Code Section 401(a) of the Internal Revenue Service (IRS) and is thus eligible to receive certain tax benefits, unlike a non ...

Qualified vs Non Qualified Retirement Plans: What's the Difference? One popular type of Non Qualified Retirement Plan is an annuity. An annuity can be classified as "Non Qualified" money, but can grow "tax deferred" just like Recently, one of our readers reached to me for retirement advice. She wanted to make some changes to her retirement plan but told me that...

Types of Retirement Plans | Internal Revenue Service Review retirement plans, including 401(k) Plans, the Savings Incentive Match Plans for Employees (SIMPLE IRA Plans) and Simple Employee Pension Plans (SEP).

Non-qualified Retirement Plan Definition: What is Non-qualified... A non-qualified retirement plan is one that does not qualify for special tax treatment under the Internal Revenue Code or the Employee Retirement Income Security Act. In essence, a non-qualified retirement plan is a contract to provide pension benefits. Individuals can create one...

Qualified vs. Non-Qualified – I Don’t Get It?! - CWM 14.01.2015 · If you’ve ever engaged in a conversation about retirement and you heard the terminology of qualified vs. non-qualified but you had no clue what that meant – know you’re not alone! The following is a basic explanation of the difference: Qualified investments are accounts that are most commonly known as retirement accounts and they receive certain tax …

A Guide to Common Qualified Plan Requirements | Internal ... A plan that provides for elective deferrals, for example a 401(k) plan, must provide that for each participant the amount of elective deferrals under the plan and all other plans, contracts, or arrangements of an employer maintaining the plan may not exceed the amount of the limitation in effect under Code section 402(g)(1) (Code section 401(a)(30)). In addition to the plan terms …

Solved: What is considered a "Qualified Retirement Plan"? Non-qualified plans are those that are not eligible for tax-deferral benefits. Internal Revenue Code Section 457 retirement plans for state and municipal employees and 403b programs for nonprofit organizations are nonqualified plans.

/what-is-a-safe-harbor-401-k-2894205-Final21-5c87e407c9e77c0001f2ad14.png)

0 Response to "39 what is a non qualified retirement plan"

Post a Comment